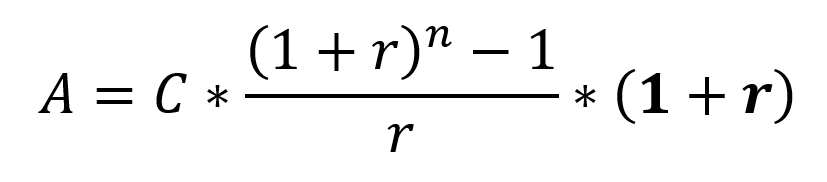

Compound interest formula with monthly contributions

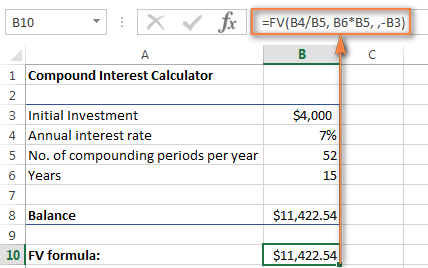

If this gives you scary high school flashbacks skip to the next section for the spreadsheet version. The annual limit for 401k contributions is 20500 in 2022 or 27000 for those 50 or older.

Compound Interest With Contributions Formula Wholesale Savings 65 Off Aarav Co

In finance and economics interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum that is the amount borrowed at a particular rate.

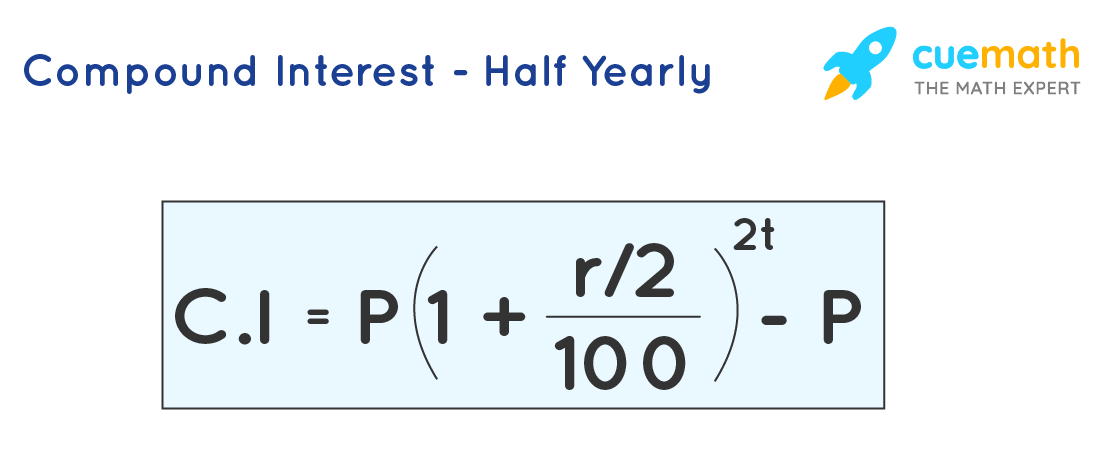

. For example a nominal interest rate of 6 compounded monthly is equivalent to an effective. Assume that you own a 1000 6 savings bond issued by the US Treasury. It is the basis of everything from a personal savings plan to the long term growth of the stock market.

Since our interest rate is the annual rate. The effective rate is calculated in the following way where r is the effective annual rate i the nominal rate and n the number of compounding periods per year for example 12 for monthly compounding. But at a lower monthly amount.

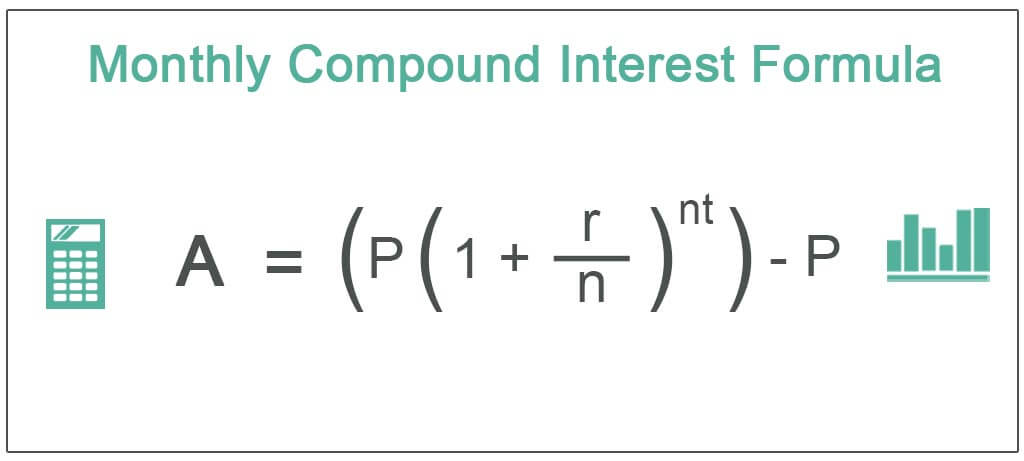

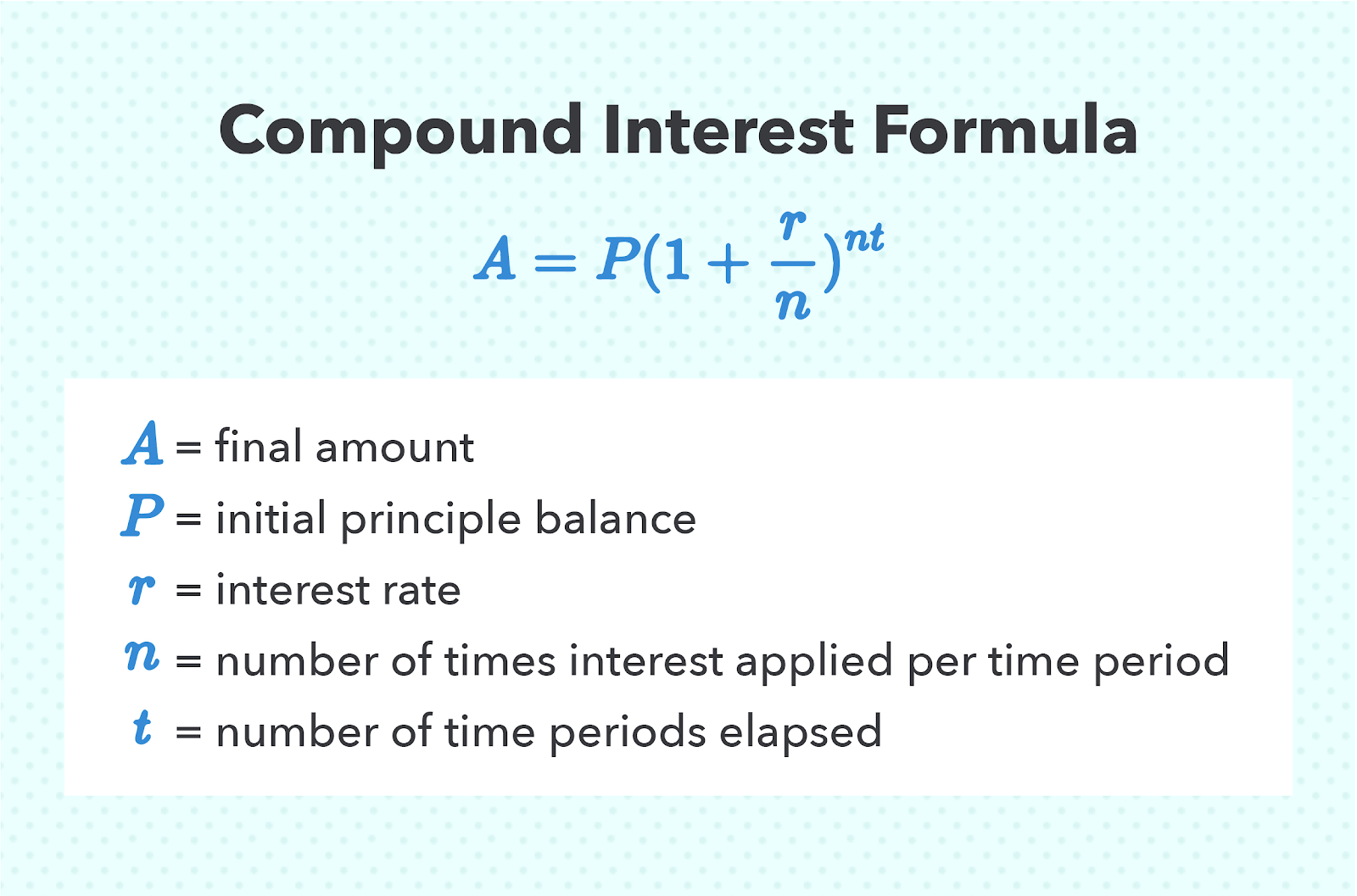

Determine how much your money can grow using the power of compound interest. Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. The compound interest formula solves for the future value of your investment A.

Be sure to include any employer matching. P the principal investment amount. Monthly Contribution of Rs10000 on or after the 5 th of each month.

If you have selected monthly contributions in the calculator the calculator utilizes monthly compounding even if the monthly contribution is set to zero. It is distinct from a fee which the borrower may pay the lender or some third party. Monthly Contribution of Rs10000 before 5 th of each month.

Computing the compound interest of an initial investment is easy for a fixed number of years. When you have all of your bills and pay stubs write down all monthly expenses. Historical Background of the Constitution of India.

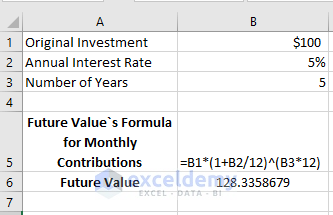

Finally we change from annual contributions and compounding to monthly. Estimate the total future value of an initial investment or principal of a bank deposit and a compound interest rate. The interest rate of a loan or savings can be fixed or floating.

It is also distinct from dividend which is paid by a company to its. T the number of periods the money is invested for. Determine all of the variables youll need and plug them into the formula before crunching the numbers.

Enter the amount you contribute to your retirement plan on a monthly basis. If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis. The Principle of Compound Interest.

Khan Abdul Ghaffar Khan Early Years Partition Arrest and Exile. Treasury savings bonds pay out interest each year based on their interest rate and current value. Use of a continuous compound interest calculator is among the various benefits of this strategy is the fact that it allows you to visualize investment horizons.

In this last scenario the investor. The other parameters stay the same. The current PPF interest rate is 71.

Well use basic math to demonstrate compound interest first. It will take 9 years for the 1000 to become 2000 at 8 interest. An individuals budget will vary depending on their lifestyle spending habits and net income.

Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. Years at a given interest. Learn the formula for compound interest.

You can clearly see the difference in the interest amount based on the difference in the timing of contributions made. I Increase yearly contributions by. Learning the compound interest formula is key to understanding your savings potential.

The interest can be compounded annually semiannually quarterly monthly or daily. N the number of times that interest is compounded per period. Bhagat Singh Background.

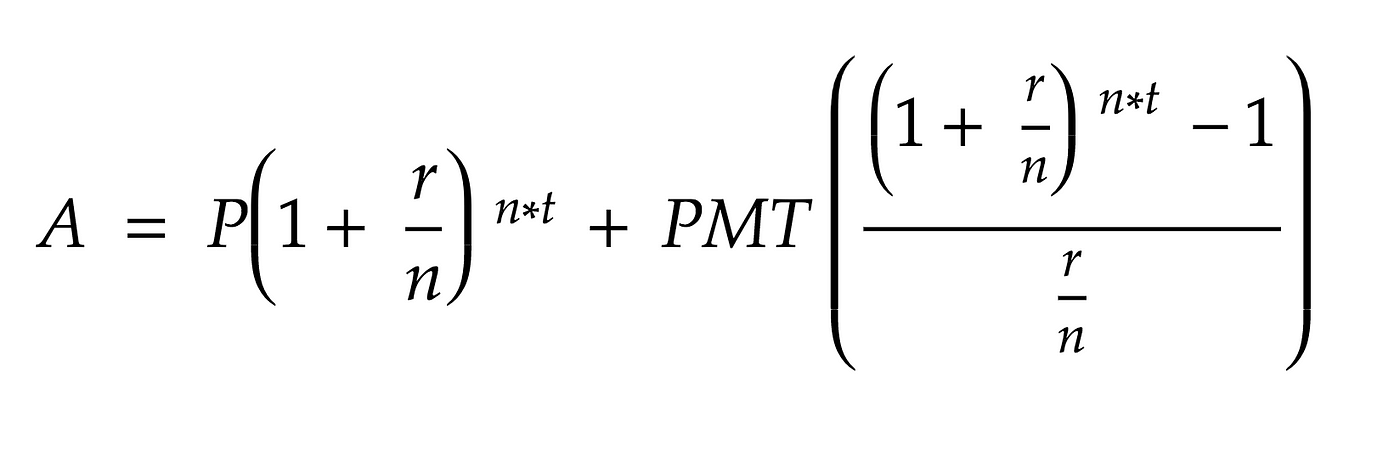

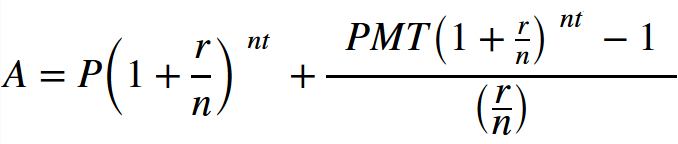

An easy approach is to separate the compounding interest for the principal from that of the monthly contributions or paymentsPMT. Constituent Assembly of India. Adjust the lump sum payment regular contribution figures term and annual interest rate.

There are two important concepts we need to use since we are using monthly contributions. List of Viceroys in India. Use the compound interest calculator to see the effects of compounding and interest rates on a savings plan.

Thought to have. The power of compound interest means you earn interest on interest. The Compound Interest Formula.

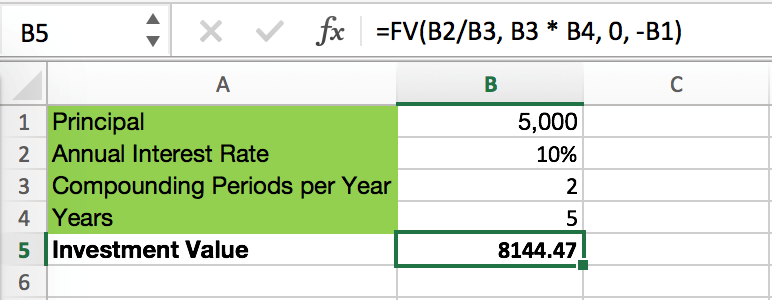

A P1rnnt A the future value of the investment. To start a budget you need to take a deep dive into how you spend your money which includes gathering all of your bills and pay stubs. When you enter an annual interest rate it calculates the future value of annuity but it can be used for monthly daily quarterly etc.

The effective interest rate is calculated as if compounded annually. If the contribution frequency is annual annual compounding is. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance.

You can find many of these calculators online. This is a compound interest calculator savers can use to get an idea of how. See how much you can save in 5 10 15 25 etc.

Amount of money that you have available to invest initially. Indian Independence Act 1947. But lets add an additional challenge.

To begin calculate the interest on the principal first using. This formula works best for interest rates between 6 and 10 but it should also work reasonably well for anything below 20. Include additions contributions to the initial deposit or investment for a more detailed calculation.

Fidelity Investments suggests that individuals have an amount equal to 1x their annual salary. Length of Time in Years. I Enter average annual inflation rate.

R the compound interest rate. Plus you can also program a daily compound interest calculator Excel formula for offline use. Future Value calculation example Let us assume a 100000 investment with a known annual interest rate of 14 from which one wants to withdraw 5000 at the end of each annual period.

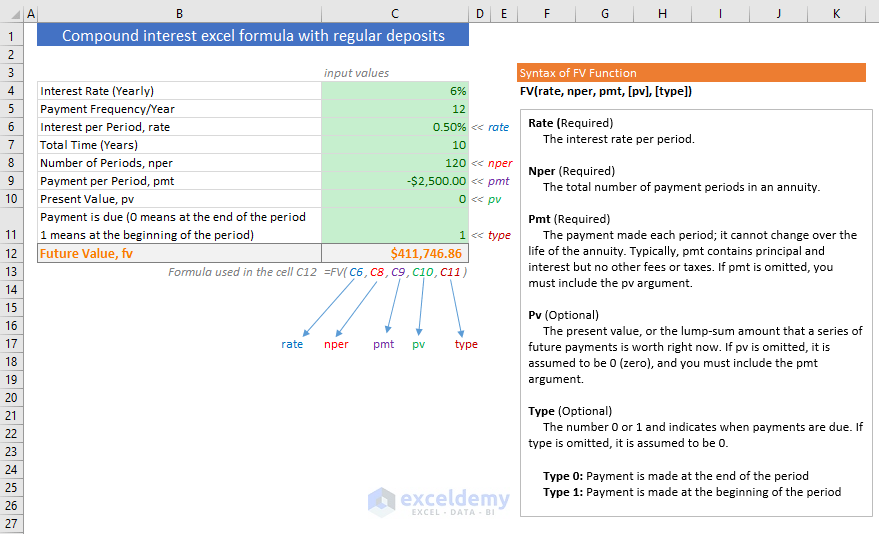

Interest paid in year 1 would be 60 1000 multiplied by 6 60. Calculation using Excels FV Formula. Wavell Plan and Shimla Conference.

Then write down your monthly. The compound interest formula used in the compound interest calculator is. Calculate interest compounding annually for year one.

Saving and investing now means letting compound interest work in your favor in the long run. C R Formula or Rajaji Formula 1944 August Offer.

Compound Interest With Contributions Formula Wholesale Savings 65 Off Aarav Co

Compound Interest Formula And Calculator For Excel

3 Ways To Calculate Bank Interest On Savings Wikihow

Compound Interest With Contributions Formula Wholesale Savings 65 Off Aarav Co

Compound Interest Formulas Derivation Solved Examples

How To Use Compound Interest Formula In Excel Exceldemy

Future Value With Monthly Compounding Period Youtube

A Story About A Graph Part 1 How To Make A Compounded Interests With By Diogo Batista Medium

Excel Formula To Calculate Compound Interest With Regular Deposits

Compound Interest Formula And Calculator For Excel

Compound Interest Formula In Excel And Google Sheets Automate Excel

How To Work Out Compound Interest On Savings 14 Steps

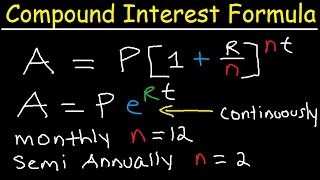

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

3 Ways To Calculate Bank Interest On Savings Wikihow

3 Ways To Calculate Bank Interest On Savings Wikihow

Compound Interest With Monthly Contributions Calculator Formula

Capitalize On Uninterrupted Compound Interest Wealth Nation